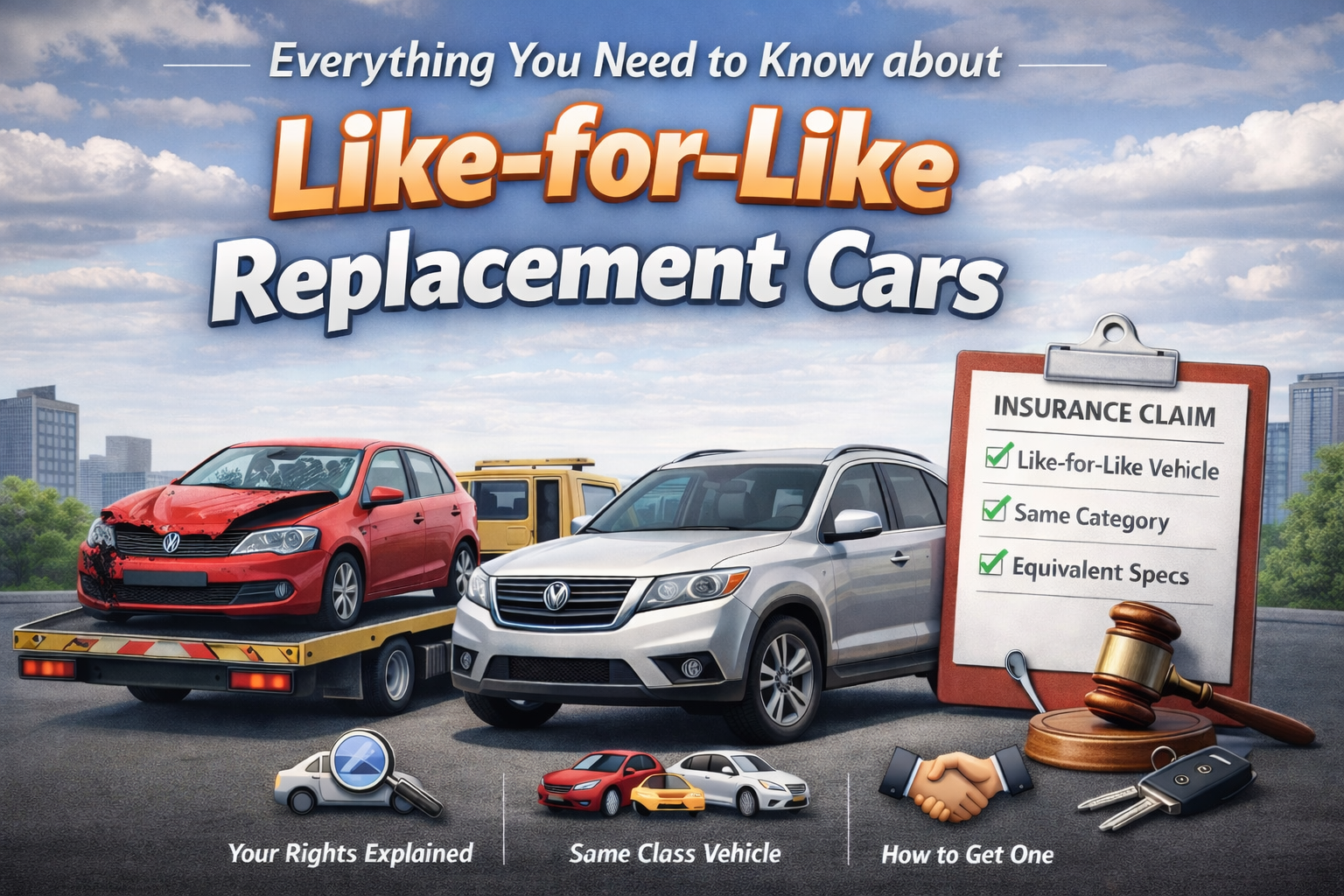

Do You Have the Right to a Replacement Car After an Accident?

UK Post-Accident support made simple: learn the vital steps for recovery, from

How Much Claim Management Company Charge for Car Accident Claim? This is the first question that comes to mind after considering a claim. If you have recently gotten involved in a no-fault accident, you can claim for repair and injuries from an at-fault party insurer. Let me break down the cost of the claim for your understanding.

Before you understand the charges of a claim management company, let’s know what an accident claim management company is.

An accident claim management company assists you when you get involved in a road traffic accident by handling the entire claims process. It includes arranging vehicle repairs, communicating with insurance companies, providing replacement cars, and managing any personal injury claims that may arise. A Claim management company aims to maximize compensation for non-at-fault parties while minimizing hassle and stress.

Understanding a claim management company’s fee structure before proceeding with the claim. I have mentioned below the two main policies regarding a claim management company’s fee structure.

Claim management companies often operate on a “No Win, No Fee” basis. This means that you do not have to pay any upfront costs. The company will only receive payment after a successful claim. A claim management company is an easily accessible way for individuals to get legal services they might not otherwise be able to afford.

Success fees are a percentage of the compensation awarded to the client. These fees typically amount to 25% to 40% of the total payout. The percentage of the fee majorly get affected by the jurisdiction and the specific terms agreed upon with the claim management company.

There can be multiple factors affecting the charges of a claim management company. Here are some of the common factors:

Let’s learn about the details of each of the factors.

Case complexity is a factor that significantly impacts the fees charged by a claim management company. The time, resources, and expertise of a company increase with the case complexity, and so does the fee. Factors contributing to the complexity of the case are as follows:

Cases that involve legal issues or require appeals can be more costly.

The duration of a claim also affects the fees. Claims that exceed the typical duration require more effort therefore the cost for these claims go higher.

The compensation amount directly influences the fees charged. Since success fees are typically a percentage of the payout, higher compensation amounts result in increased fees for a claim management company.

You may require some additional services sometimes to support a claim, such as:

You need a medical assessment to establish the extent of injuries.

You also need expert witnesses to testify on the case’s technical elements.

Although these additional services can increase the overall cost, they are often essential for building a strong case.

To build a better understanding of what to expect, here is a table for you of the typical fees associated with different compensation amounts:

| Compensation Amount | Typical Fee Range |

| £1,000 – £5,000 | £250 – £1,250 |

| £5,000 – £10,000 | £1,250 – £2,500 |

| £10,000 – £25,000 | £2,500 – £6,250 |

| £25,000+ | £6,250+ |

The fee range can vary based on the specifications of the claim and the company’s fee structure. For instance, if a client receives £10,000 in compensation and the success fee is 30%, the claim management company will get £3,000.

An accident management company offers start-to-end handling of your claim. Using their insurance company is the only option for the at-fault party in an accident. However, for you as a not-at-fault party, going through your insurance company isn’t the most effective decision to make because it can affect your no-claims bonus and insurance premiums.

An accident management company can lower the risk for your case. Having a professional with you during the process helps you navigate your way through your claim and come out to the end as least affected.

Continental Car Hire does not charge our clients directly for handling car accident claims. We operate on a “No Win, No Fee” basis, so you do not have to pay any upfront costs. However, we recommend a solicitor for your legal matters. They charge a fee for their services depending on the complexity of your case.

Here’s a breakdown of how Continental Car Hire works with car accident claims:

You do not pay any fees to Continental Car Hire for our services. We manage the claim process and provide support services like vehicle replacement.

The solicitors recommended by Continental Car Hire charge a success fee. The solicitor’s fee is deducted from the compensation which is usually between 25% and 35% of the total compensation.

Continental Car Hire offers additional services such as vehicle storage, recovery, and credit hire without charging you directly. These costs are typically recovered from the at-fault party’s insurance.

In conclusion, contacting an accident+ claim management company for a car accident claim is a wise decision. It will keep you safe from legal worries. Choosing the right claim management company is essential to avoid scams or fraud.

To ensure a successful claim, contact Continental Car Hire for the best services and a seamless process.

The most common charging method is a percentage fee, where the claim company takes a portion of the total compensation received. It can vary from 15% to 40% of the compensation amount, plus VAT.

These companies generate an income by charging a fee that’s either a percentage of the final claims settlement, a flat lump sum, or sometimes both. Before starting the process, you must discuss the fee structure with the company concerned.

The insurance company of the driver who caused the accident is responsible for all costs of any replacement vehicle and repairs to your car. There is no fee for the accident management service, as all costs are recovered from the insurers involved.

The short answer is ‘Yes,’ failing to report an accident to your motor insurers, even if you do not intend to make any claim on your policy, can have serious consequences.

UK Post-Accident support made simple: learn the vital steps for recovery, from

UK Post-Accident support made simple: learn the vital steps for recovery, from

UK Post-Accident support made simple: learn the vital steps for recovery, from

UK Post-Accident support made simple: learn the vital steps for recovery, from

UK Post-Accident support made simple: learn the vital steps for recovery, from

UK Post-Accident support made simple: learn the vital steps for recovery, from

Copyright © 2025 Continental Car Hire Ltd. All Rights Reserved.

Continental Car Hire Ltd is authorised and regulated by the Financial Conduct authority (FRN 711301)