When it comes to car accidents, it is essential to understand the difference between a non-fault accident and an at-fault accident. Knowing these differences lets you understand how they might significantly improve your insurance premium and how the claim process unfolds.

Noting the difference between these two claims can help you understand the impact of insurance policies.

No doubt, you are free to file a claim through your insurance company. Filing your claim through an insurer might lead to increased premiums. Even if you are a non-faulty, an insurer will increase the premium cost at the time of renewal.

The main reason for the increased premium is that claim processing can take up to 12 months.

At the time of renewal, you must pay the excess premium cost during the claim processing.

Not only increased premiums but filing a claim through an insurer will also affect the overall insurance policy even if you are a non-faulty.

You must pay insurance excess when choosing an insurance company to file a claim after a non-fault accident. After processing your accident claim through your insurer, you have to pay for the agreed excess, either you win or lose.

Processing a claim through an insurer will affect the no-claim bonus as it will be reduced by two years accordingly. You’ll lose it entirely if you don’t protect your no-claim bonus when filing a non-fault accident claim.

It will take almost 12 months for your insurer to recover all losses from the faulty party insurer. In addition to the affected no-claim bonus, the premium cost will also increase between 20% and 50% according to the risk and severity of the accident.

The insurance company usually offers low-quality repairs to reduce labour and parts replacement costs. That’s why, most of the time, these repairers use fake or low-quality parts that can affect the car’s value and performance in the long run.

These low-quality repairs may also affect your vehicle’s warranty. So, be careful when relying on your insurer for accidental repairs and filing a claim after a non-faulty accident.

If you want to get your car repaired by your desired technician or automotive garage after a non-faulty accident, an insurer will force you to pay for those repairs yourself.

This is because they want to earn a commission or save costs by referring your car to their linked garages.

Because of high risks, insurance companies may undervalue your car after a non-fault accident. The insurer will not provide you with the evidence to showcase the actual worth of your vehicle.

However, you can inspect the actual value of your car if you want by hiring an experienced inspector. It will take much time and effort to prove that you are entitled to maximum compensation through an insurer.

Most of the time, insurance companies don’t have a team of legal solicitors or claim handlers. They refer your case to an independent claim handler and request a referral fee. The only thing the insurers do is ask for the premiums and insure the vehicles. That’s all!

An accident claim management company always offer a quick solution to file a non-fault accident claim. Moreover, you can also ask for customized services according to your claim needs and requirements.

A claim management company always offers a solution based on a no-win, no-fee basis. So, there is no chance of additional costs and charges. Here are a few extra benefits of hiring a claim management company that helps to make a wise decision;

Claiming for maximum compensation after a non-fault accident is a crucial process. If you proceed with an accident claim management company, you can start this process without delay.

A claim management company ensures that the claim is processed proficiently and within a minimum time frame compared to an insurance company.

A claim management company proceeds with the non-fault accident claim on a no-win, no-fee basis. So, there is no need to pay even a single penny if you lose the case. However, you must pay the solicitor fee if it is found faulty.

A claim management company always has a team of experienced and well-trained claim handlers. These skilled people will proceed with your claim with great care and consideration so you can receive maximum compensation without any challenges.

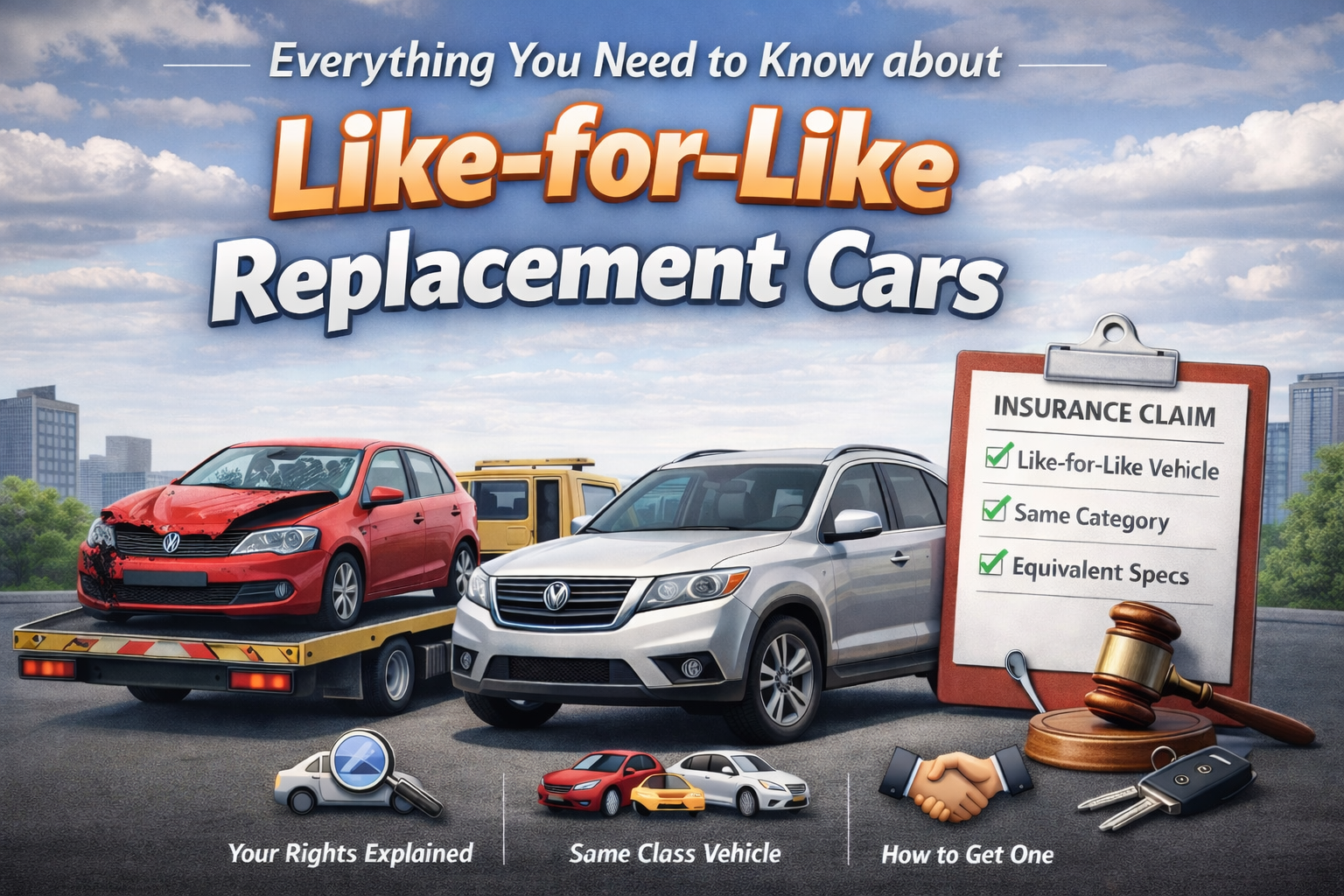

A claim management company will also provide you with a like-for-like replacement vehicle. So, there is no need to be off-road even if your car is unroadworthy after a non-fault accident. You can get the replacement car within two hours of the accident.

Professional accident claim management companies like Continental Car Hire offer 24/7 roadside assistance and recovery services. If you have been involved in a non-faulty accident and left with an undrivable car on the road, call Continental Car Hire for prompt recovery & storage.

If you don’t have enough space to park your damaged car, a claim management company like CCH will keep it secured in our storage until it is repaired.