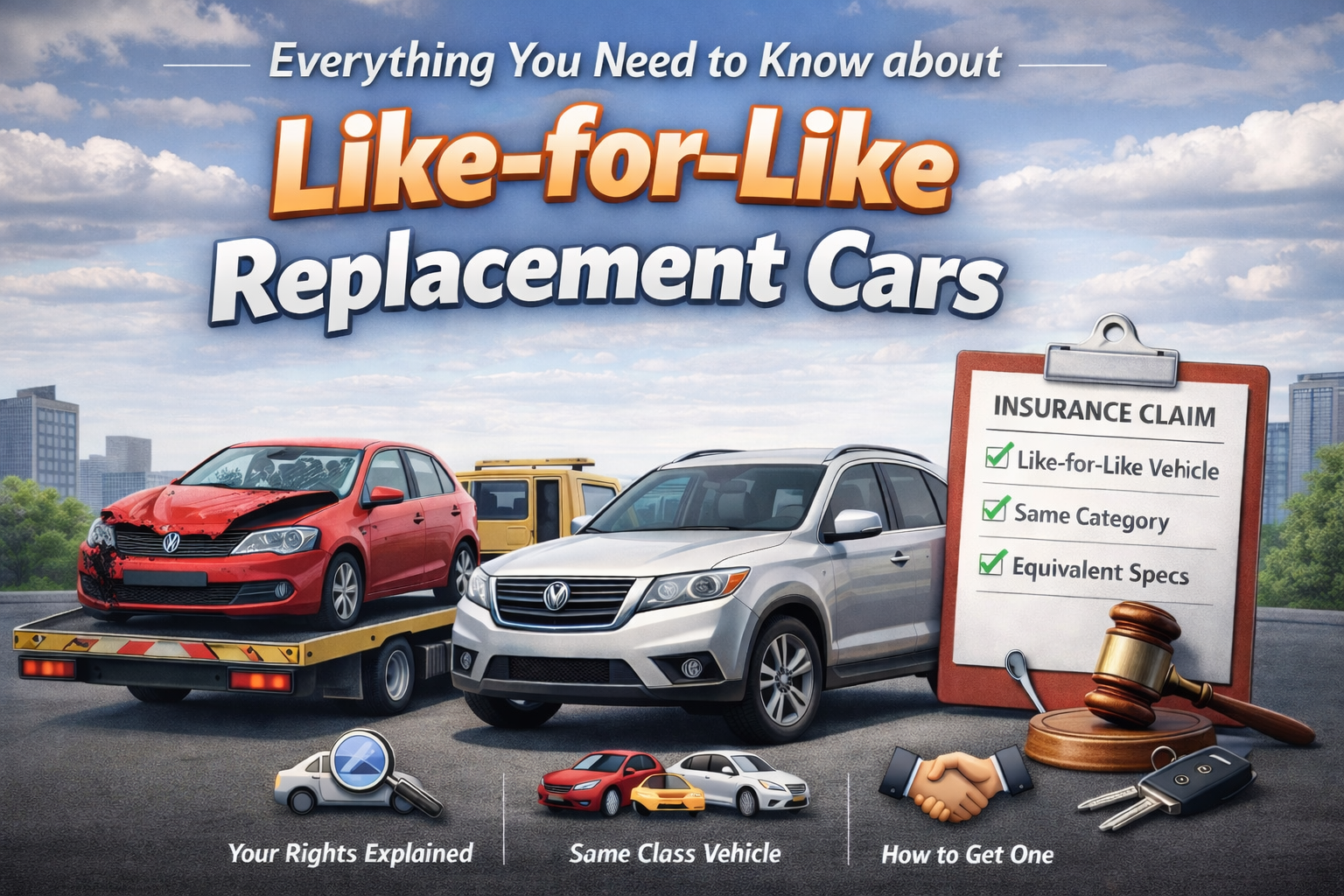

Do You Have the Right to a Replacement Car After an Accident?

UK Post-Accident support made simple: learn the vital steps for recovery, from

Being involved in a car accident that was not your fault, your insurance should cover your back. But wait, what will happen after that? Is it enough? If you think proceeding with your claim with your insurance company will not affect your no-claim bonus, you might be wrong.

Thousands of people avoid making a non-fault accident claim to insurance to protect their no-claim bonus.

Before filing a non-fault claim for a road accident, understanding the difference between at-fault and non-fault claims is crucial.

If you are searching for the query “Will a non-fault accident affect my insurance?” Simply read out this guide.

When it comes to car accidents, it is essential to understand the difference between a non-fault accident and an at-fault accident. Knowing these differences lets you understand how they might significantly improve your insurance premium and how the claim process unfolds.

Noting the difference between these two claims can help you understand the impact of insurance policies.

No doubt your car accident and claiming non-fault will increase the premium rate cost of your car insurance. Although it must have the effect that making an at-fault claim would. If you decide to change your insurer, you would expect a new provider to ask about your claim history. Your insurance premium will not directly increase after submitting your non-fault claim to the insurer, but a few elements will help to raise it in future:

When claiming a non-fault accident to the insurer, it might be unfair to lose your no-claim bonus, even if that was not your fault. After all, no claim bonus refers to a clean driving record without any accident.

This implies that you will lose your no-claim discount and increase the premium in the future. A non-fault claim will have less impact. Sometimes, it depends on whether the insurance company wants to deduct your no-claim bonus.

As a policyholder, your insurance company expects you to cover the total policy excess when making a claim. Once the compensation is processed, you must claim this back from the at-fault driver's insurance firm.

If you're financially able, consider paying out minor damages instead of making a claim. If you must pay for repairs and your voluntary excess, gather repair quotes beforehand to estimate whether you'll likely receive a payout from your insurer.

Here are a few things that help you understand why accident management company consideration is best among your insurers:

UK Post-Accident support made simple: learn the vital steps for recovery, from

UK Post-Accident support made simple: learn the vital steps for recovery, from

UK Post-Accident support made simple: learn the vital steps for recovery, from

UK Post-Accident support made simple: learn the vital steps for recovery, from

UK Post-Accident support made simple: learn the vital steps for recovery, from

UK Post-Accident support made simple: learn the vital steps for recovery, from

Copyright © 2025 Continental Car Hire Ltd. All Rights Reserved.

Continental Car Hire Ltd is authorised and regulated by the Financial Conduct authority (FRN 711301)